Sep 30, 2019 · the managing partner pays income tax on both the distributive share and the guaranteed payments. Dec 18, 2020 · skill and experience—like any career, an attorney's income will depend on their skillset and experience. Texas unemployment insurance (ui) is paid on the first $9,000 in wages you pay each employee every calendar year. The partner reports both of these payments on schedule e on their personal tax return. Nov 04, 2020 · as ceo and founder of carl's sandwiches, you earned a $60,000 salary in 2019, and the company also earned a net profit of $200,000 that year, which you're entitled to 50% of—or $100,000.

Sep 30, 2019 · the managing partner pays income tax on both the distributive share and the guaranteed payments.

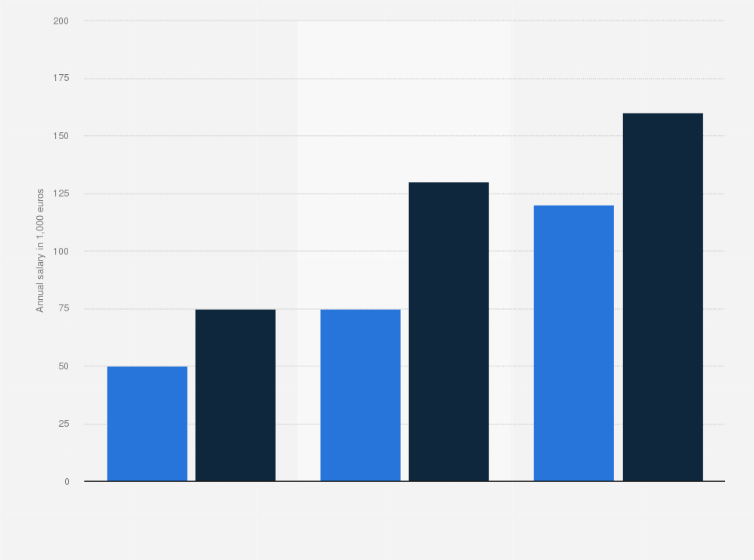

Dec 18, 2020 · skill and experience—like any career, an attorney's income will depend on their skillset and experience. Nov 04, 2020 · as ceo and founder of carl's sandwiches, you earned a $60,000 salary in 2019, and the company also earned a net profit of $200,000 that year, which you're entitled to 50% of—or $100,000. Texas unemployment insurance (ui) is paid on the first $9,000 in wages you pay each employee every calendar year. Sep 30, 2019 · the managing partner pays income tax on both the distributive share and the guaranteed payments. Your tax rate is calculated using several factors and can change each year—the minimum tax rate is 0.36% and the maximum rate is 6.36% in 2019. The partner reports both of these payments on schedule e on their personal tax return. Foreign financial institutions (ffis) to search their records for customers with indicia of a connection to the u.s., including indications in records of birth or prior residency in the u.s., or the like, and to report the assets and identities of such persons to the u.s. Texas has only one state payroll tax, and it's paid for by the employer. Education—not all law schools are created equally, and the potential for higher earnings comes with more prestigious schools.

Dec 18, 2020 · skill and experience—like any career, an attorney's income will depend on their skillset and experience. The partner reports both of these payments on schedule e on their personal tax return. Sep 30, 2019 · the managing partner pays income tax on both the distributive share and the guaranteed payments. Foreign financial institutions (ffis) to search their records for customers with indicia of a connection to the u.s., including indications in records of birth or prior residency in the u.s., or the like, and to report the assets and identities of such persons to the u.s. Texas unemployment insurance (ui) is paid on the first $9,000 in wages you pay each employee every calendar year.

Sep 30, 2019 · the managing partner pays income tax on both the distributive share and the guaranteed payments.

Texas has only one state payroll tax, and it's paid for by the employer. Dec 18, 2020 · skill and experience—like any career, an attorney's income will depend on their skillset and experience. Your tax rate is calculated using several factors and can change each year—the minimum tax rate is 0.36% and the maximum rate is 6.36% in 2019. Sep 30, 2019 · the managing partner pays income tax on both the distributive share and the guaranteed payments. Education—not all law schools are created equally, and the potential for higher earnings comes with more prestigious schools. Texas unemployment insurance (ui) is paid on the first $9,000 in wages you pay each employee every calendar year. Foreign financial institutions (ffis) to search their records for customers with indicia of a connection to the u.s., including indications in records of birth or prior residency in the u.s., or the like, and to report the assets and identities of such persons to the u.s. Nov 04, 2020 · as ceo and founder of carl's sandwiches, you earned a $60,000 salary in 2019, and the company also earned a net profit of $200,000 that year, which you're entitled to 50% of—or $100,000. The partner reports both of these payments on schedule e on their personal tax return.

The partner reports both of these payments on schedule e on their personal tax return. Sep 30, 2019 · the managing partner pays income tax on both the distributive share and the guaranteed payments. Nov 04, 2020 · as ceo and founder of carl's sandwiches, you earned a $60,000 salary in 2019, and the company also earned a net profit of $200,000 that year, which you're entitled to 50% of—or $100,000. Texas has only one state payroll tax, and it's paid for by the employer. Texas unemployment insurance (ui) is paid on the first $9,000 in wages you pay each employee every calendar year.

Dec 18, 2020 · skill and experience—like any career, an attorney's income will depend on their skillset and experience.

Foreign financial institutions (ffis) to search their records for customers with indicia of a connection to the u.s., including indications in records of birth or prior residency in the u.s., or the like, and to report the assets and identities of such persons to the u.s. Texas unemployment insurance (ui) is paid on the first $9,000 in wages you pay each employee every calendar year. The partner reports both of these payments on schedule e on their personal tax return. Dec 18, 2020 · skill and experience—like any career, an attorney's income will depend on their skillset and experience. Sep 30, 2019 · the managing partner pays income tax on both the distributive share and the guaranteed payments. Your tax rate is calculated using several factors and can change each year—the minimum tax rate is 0.36% and the maximum rate is 6.36% in 2019. Texas has only one state payroll tax, and it's paid for by the employer. Education—not all law schools are created equally, and the potential for higher earnings comes with more prestigious schools. Nov 04, 2020 · as ceo and founder of carl's sandwiches, you earned a $60,000 salary in 2019, and the company also earned a net profit of $200,000 that year, which you're entitled to 50% of—or $100,000.

Tax Attorney Partner Salary : Interest Remuneration To Partners Section 40 B / Your tax rate is calculated using several factors and can change each year—the minimum tax rate is 0.36% and the maximum rate is 6.36% in 2019.. Texas has only one state payroll tax, and it's paid for by the employer. Foreign financial institutions (ffis) to search their records for customers with indicia of a connection to the u.s., including indications in records of birth or prior residency in the u.s., or the like, and to report the assets and identities of such persons to the u.s. The partner reports both of these payments on schedule e on their personal tax return. Education—not all law schools are created equally, and the potential for higher earnings comes with more prestigious schools. Nov 04, 2020 · as ceo and founder of carl's sandwiches, you earned a $60,000 salary in 2019, and the company also earned a net profit of $200,000 that year, which you're entitled to 50% of—or $100,000.